Some of you might be aware of significant changes ahead for hospitals and how they share their prices. Up until now, the rates hospitals and systems negotiated with commercial payers, Medicare Advantage included, were “trade secrets.” You might be able to obtain the charge or “list price” for your hip replacement, but determining the dollar details of a hospital contract with payer X vs. Y is impossible.

A final rule issued by CMS this summer will require hospitals to provide patients with up-to-date information about gross charges, payer-specific negotiated prices, discounted cash prices (for the uninsured, for example), and “deidentified” minimum and maximum negotiated prices (IOW, “opening the books”).

Additionally, the final rule also mandates that hospitals display charges (not the more valuable discounted prices) for 300 shoppable services on their websites in a consumer forward manner. Failure to comply with the final rule which CMS slates to go into effect on January 1, 2021, will result in fines. The American Hospital Association and three other hospital associations said they would appeal the ruling. No kidding.

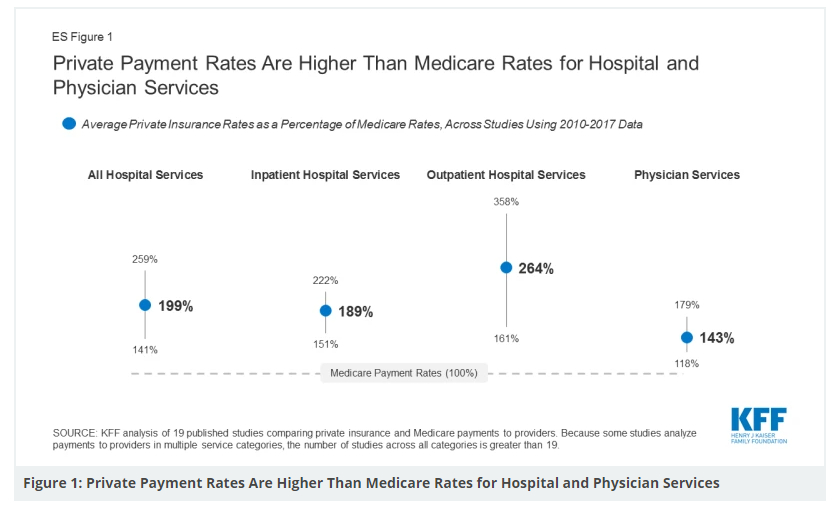

To give you a sense of the price variation between commercially negotiated rates and Medicare, CMS being king on the publicly funded, administered pricing side of things, see the figure below.

In case you are unaware of what administered pricing translates to, by the way, it’s Medicare’s ability to pay a set price via pre-set formulas, no questions asked, adjusted for regional wage and economic factors. You ask for $25K for a big op procedure, you get $15K. You ask for an ICU stay, you get $21.5K. Take it or leave it.

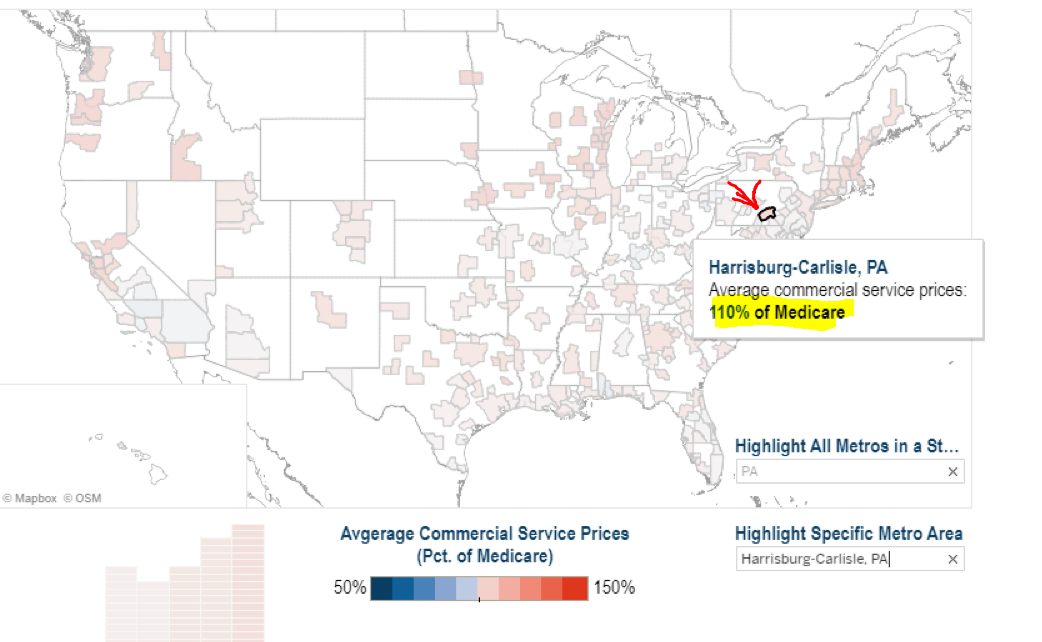

Here is a nice dataset from HCCI, and I snapped a shot of Harrisburg, PA (my state capital–not bad–but state to state mileage will vary). You can see the region’s commercial negotiated prices are 10% above Medicare.

Hospital A might get $5000 for a particular DRG, and on average, the same hospital will get 1.89x that for the same procedure from a commercial carrier. Go to the two-minute read DISCUSSION section at the bottom HERE to get a fuller take. A taste:

Some providers have argued that Medicare payment rates are too low to cover the reasonable cost of care, and that these shortfalls lead them to raise prices for private payers. However, much of the literature suggests that providers negotiate prices with private insurers irrespective of Medicare rates, and that providers with substantial market power are best positioned to command high prices, allowing them to evade financial pressure to become more efficient.

You can imagine our hospitals are overjoyed at the prospect of putting together and displaying the data in a convenient format – especially the growing collection of massive systems around the country. Think regs, cost, and FTE time. However, CMS and most economists are clear and insistent: they expect the data will lower costs, encourage third-party vendors (think building search platforms for hospital prices), and create patient evaluation tools for more efficient decision-making.

I will add if the rule gets past the AHA challenge, a Democratic or Republican future administration will not be rolling back the advance. The transparency engendered by price reveals will be wicked for institutional providers and us – but will have a salutary effect on the Treasury purse if things go according to CMS plans. Politicians will find results of that sort a winning approach to taxpayer dollar stewardship, and a hard one to reject as it relates to public policy and allocating precious bucks.

thanks. the contracted price for a gallbladder between my Sutter health and aetna would have to be posted? and the price medi-care and the medi-aids, too?